Nottingham Building Society appoints Russ Thornton as chief technology officer

Nottingham Building Society has appointed Russ Thornton as chief technology officer (CTO), following his role as interim adviser since March 2025.

Thornton takes over from Paul Howley, who joined the 176-year-old mutual in 2022 as its first chief technology and transformation officer. During Howley’s time in the role, the building society introduced a range of technology initiatives, including partnerships with MQube for the Origo mortgage origination platform and Nova Credit for its Credit Passport cross-border credit solution.

Before joining Nottingham Building Society, Thornton led a digital overhaul at Shawbrook Bank, where he integrated Pegasystems for automated underwriting, implemented Cashflows for business finance payments, and deployed nCino’s cloud banking platform to automate loan origination and portfolio management processes. Thornton has also worked as CTO for WorldRemit, McKinney Rogers, and Cofunds.

The appointment comes alongside another senior hire, with former Santander UK executive Aaron Shinwell set to join Nottingham Building Society as chief lending officer in August 2025.

Nottingham Building Society also recently reported a profit of £11 million for the six months to the end of June 2025. The results also showed an increase in gross new lending to £535.1 million, a rise of nearly 2%, and total mortgage assets growing by almost 13% to £4.4 billion.

Chief executive officer Sue Hayes said: “We’re pleased to report a positive performance for the first half of 2025 as we consolidate the momentum built during a landmark 2024. Last year, we passed the £5bn asset milestone, delivered significant growth and recorded our highest-ever savings levels. Entering this year, our focus has been on building long-term resilience – ensuring the right foundations are in place for a sustainable future.

“Our strategy in 2025 is a deliberate one: to moderate lending growth while we implement new technology, strengthen our core banking systems and evolve our mortgage proposition to better serve customers who don’t fit the traditional mould. This transformation will enable us to grow with greater speed and agility in 2026 and beyond.”

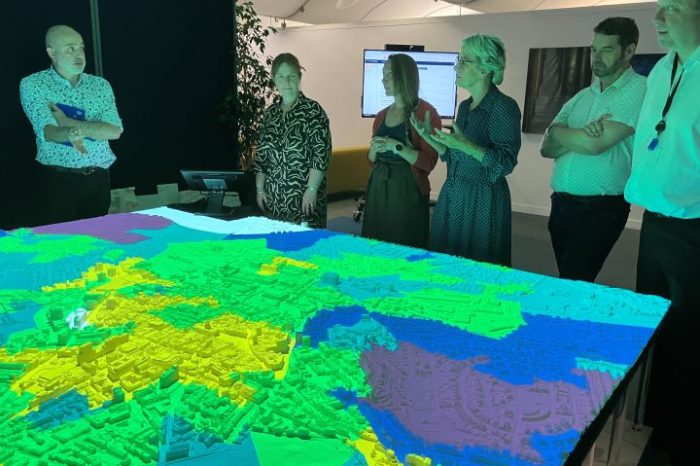

Image source: Nottingham Building Society