AI-powered, London-based fintech, ANNA Money, has secured a £10 million growth debt deal with Flashpoint to accelerate its expansion ahead of changes to the UK tax reporting system for self-employed individuals and landlords.

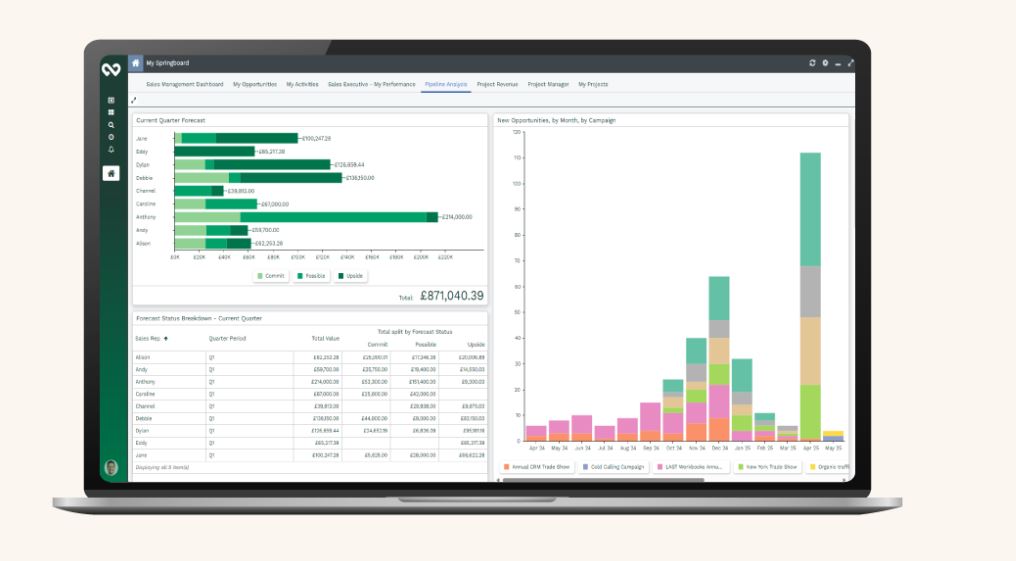

ANNA stands for Absolutely No Nonsense Admin, and the fintech firm, which provides an all-in-one platform for business accounts, invoicing, payroll and taxes, will use the funding to support scaling its operations as the April 2027 compulsory Making Tax Digital (MTD) initiative changes how small businesses manage their finances.

The agreement is with Flashpoint, an international technology investment firm with approximately £445 million in assets under management. Flashpoint focuses on technology companies from Europe, the Middle East and North Africa. This investment follows a year of growth for the London-based business, which has reached £30 million in annual recurring revenue and has more than 50,000 UK small businesses using the platform each month.

The platform is designed to simplify small business management by centralising banking and finance administration. From April 2026, Making Tax Digital for Income Tax Self Assessment (ITSA) will require self-employed people and landlords with annual income over £50,000 to move from a single annual return to quarterly digital updates and a final declaration submitted via approved software. ANNA Money stated that it provides an MTD-ready solution through its Auto Accountant tool, which prepares and submits digital updates once a business account is linked.

The firm expects the shift to digital reporting to encourage more small businesses to use automated finance tools and anticipates that 2026 will be a notable year for the industry. Its next target is to reach £100 million in revenue, with the new funding intended to support the growth of its automated accounting services across the UK.

Eduard Panteleev, co-founder and co-CEO of ANNA Money, said: “This funding gives us the firepower to scale at exactly the right moment. As MTD for self assessment comes into force for around 850k self-employed people and landlords next year, demand for smart, automated accounting is accelerating fast. ANNA’s AI-driven systems mean a single human accountant can work across up to 12,000 businesses: the technology does the rest. That level of efficiency allows us to grow rapidly while maintaining exceptional customer service. With this backing, we’re doubling down on our self-drive accountant and moving decisively towards our ambition of becoming the leading tax SaaS platform for small businesses.”

Denis Mosolov, managing partner at Flashpoint, added: “ANNA Money is building exactly the kind of category-defining platform we look to support: one that combines strong fundamentals, clear product-market fit and the ability to scale efficiently through technology. With MTD accelerating a structural shift in how UK small businesses manage their finances, ANNA is exceptionally well-positioned to lead the transition to AI-powered accounting. We’re excited to partner with Eduard, Boris and the team as they scale their platform, deepen automation and move toward their ambition of becoming the leading accounting, tax and admin solution for small businesses.”

Image source: ANNA Money