A Dorset-based performing arts software company is set to “raise the curtain on the next stage of growth” after securing new funding. Stage School Software has received a £200,000 loan from the British Business Bank’s South West Investment Fund, managed by The FSE Group.

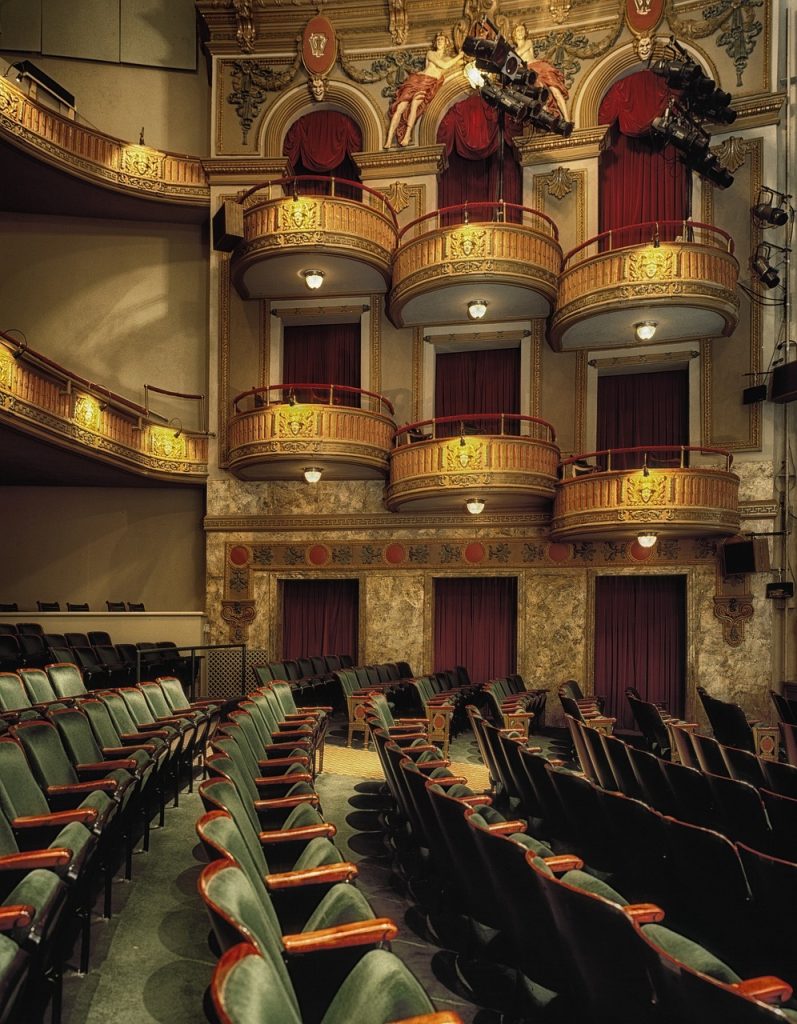

Founded in 2023 by Chris Witham, who also owns the Swish of the Curtain Theatre School, Stage School Software was created to meet the administrative needs of Swish’s franchisees across the south of England. The company has since expanded its reach to provide its platform to performing arts schools throughout the region.

Its flagship product, the Enrolio app, is designed to streamline the management of theatre and dance schools. The platform allows schools to handle student sign-ups, process fees, and communicate with parents through a unified messaging system. It also offers a white-labelled option, enabling schools to create branded platforms with custom domains, flexible payment setups, multi-parent support, and scalable infrastructure.

Chris Witham says the funding will support the further development of the Enrolio platform, boost marketing initiatives, and enable new staff hires. He commented: “This support is instrumental. As an early-stage business with a limited track record, Stage School Software is not currently in a position to obtain high-street funding. FSE was able to see the potential of the business across the franchise base and beyond, agreeing to the South West Investment Fund loan and completing the deal just seven days later. I look forward to working with FSE in the future.”

Paul Jones, senior investment manager from the British Business Bank, said: “Chris has come a long way from collecting pound coins from stage students in chilly parish halls in the 1990s to a well-established performing arts franchise today. Stage School Software is a natural extension of that, applying digital innovation to remove administrative chores for theatre and dance schools across the UK. We hope support from the South West Investment Fund raises the curtain on the next stage of growth.”

The South West Investment Fund offers loans from £25,000 to £100,000, debt finance up to £2 million, and equity investment up to £5 million, helping smaller businesses access funding they might otherwise struggle to secure.

Image source: Pixabay